Automated Rent Collection: Complete Guide to Benefits, Technology, and Real-World Examples

Managing rental payments has long been a challenge for landlords and property managers. Late checks, missed payments, and manual bookkeeping make the process stressful and inefficient. With the rise of technology, however, automated rent collection has become a game-changer in property management.

This guide explores how automated rent collection works, the technology behind it, the benefits for landlords and tenants, and detailed real-world examples of platforms that simplify rent management.

What is Automated Rent Collection?

Automated rent collection is the process of using digital tools and property management platforms to collect rent electronically, without the need for manual checks or in-person payments. Tenants can pay via bank transfer, credit card, or digital wallet, while landlords receive funds directly into their accounts.

The system sends reminders, enforces late fees, and records payments automatically, reducing the burden on landlords and making life easier for tenants. This solution is especially valuable for property managers overseeing multiple units, where manual rent collection would otherwise consume significant time and resources.

How Automated Rent Collection Works

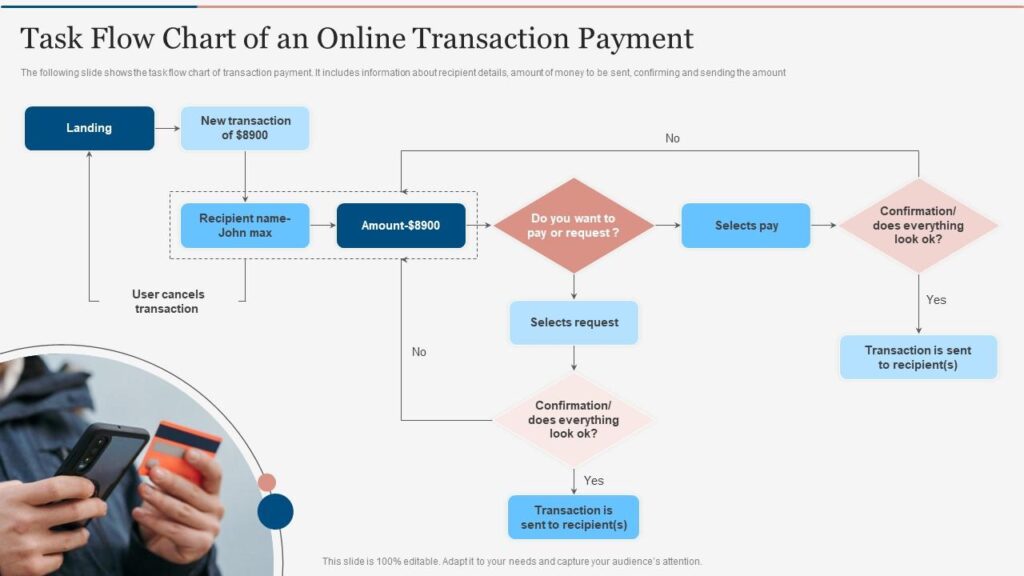

The process of automated rent collection involves a few key steps. First, tenants are onboarded into a digital payment system where they can set up recurring payments. Once enrolled, the platform automatically deducts rent on the due date and transfers it securely to the landlord.

The software also integrates with accounting tools, ensuring all transactions are logged accurately. Notifications are sent to both landlords and tenants, providing real-time visibility into payment status. This eliminates uncertainty and minimizes disputes.

Key Features of Automated Rent Collection

Recurring Payments

One of the strongest features is the ability to set up recurring payments. Tenants can authorize automatic deductions from their accounts, ensuring rent is always paid on time.

Recurring payments also give landlords peace of mind, as they no longer need to chase tenants each month. This consistency improves financial planning and reduces stress for both parties.

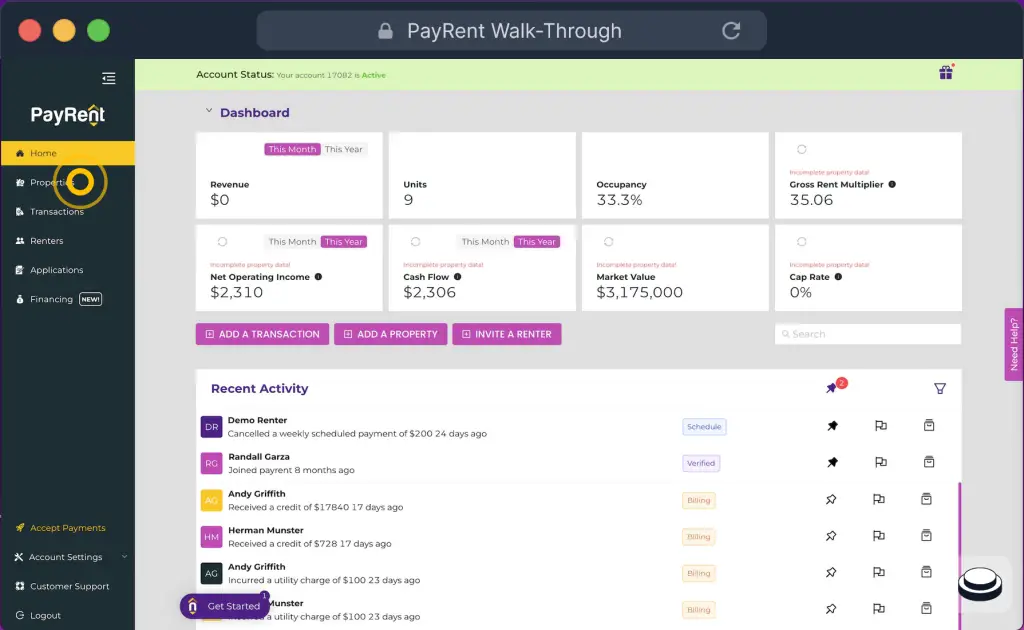

Integrated Financial Reporting

Automated rent collection platforms often include financial reporting features. Every transaction is tracked, categorized, and available for export during tax season.

This integration saves hours of manual bookkeeping, ensuring landlords have a clear picture of cash flow, rental income, and outstanding balances. For property managers, it simplifies managing multiple units across different properties.

Secure Payment Processing

Security is central to automated rent collection. Platforms use encryption and secure payment gateways to protect sensitive information. Both landlords and tenants benefit from safe, fraud-resistant transactions.

For tenants, this is far more secure than mailing checks. For landlords, it reduces risks associated with handling cash or storing sensitive data.

Real-World Examples of Automated Rent Collection Platforms

Example 1: Buildium

Buildium is a cloud-based property management platform that includes automated rent collection as one of its core features. Tenants can pay rent via credit card, ACH transfers, or debit cards, while landlords receive instant notifications of payment status.

What makes Buildium powerful is its integration with full accounting tools. Property managers can generate detailed reports, reconcile bank statements, and track expenses alongside rent payments. This makes it especially useful for those managing larger portfolios.

Example 2: AppFolio

AppFolio offers automated rent collection with additional features like flexible payment options and mobile app integration. Tenants can pay directly from their phones, schedule recurring payments, and receive reminders before rent is due.

For property managers, AppFolio provides a centralized dashboard to track rent across multiple properties. Its automation reduces late payments significantly while improving tenant satisfaction through ease of use.

Example 3: RentRedi

RentRedi is designed for independent landlords and small property managers. Its automated rent collection system supports recurring payments, late fee automation, and instant payment notifications.

What sets RentRedi apart is its affordability and user-friendly interface. Landlords who don’t need enterprise-level solutions benefit from a simple yet powerful tool that eliminates the hassle of manual collections.

Example 4: Cozy (Now Part of Apartments.com)

Cozy, now integrated with Apartments.com, is a popular platform for smaller landlords who want to collect rent automatically without heavy software costs. Tenants can pay online using ACH transfers or credit cards, while landlords enjoy free and straightforward rent deposits.

This tool is especially popular among DIY landlords who want a low-maintenance, no-fuss solution for rent collection. Its simplicity and integration with rental listings make it a valuable all-in-one tool.

Benefits of Using Automated Rent Collection

Automated rent collection offers numerous advantages for landlords, property managers, and tenants alike.

For landlords, it ensures consistent cash flow, minimizes the stress of late or missed payments, and provides detailed records for financial management. Automated reminders reduce disputes, while digital trails offer legal protection in case of conflicts.

For tenants, automated rent collection makes paying rent easy and convenient. They can set up payments once and never worry about missing a due date. The option to pay online also eliminates the hassle of writing checks or making trips to the bank.

For property managers, especially those handling hundreds of units, automated systems save countless hours of manual work, allowing them to focus on improving tenant relationships and growing their businesses.

Practical Use Cases of Automated Rent Collection

Independent Landlords

Independent landlords often struggle with late payments and manual tracking. Automated rent collection helps them maintain consistent income, improve tenant relationships, and reduce administrative burden.

For example, a landlord with five units can receive all payments on time each month while maintaining digital records for taxes without extra effort.

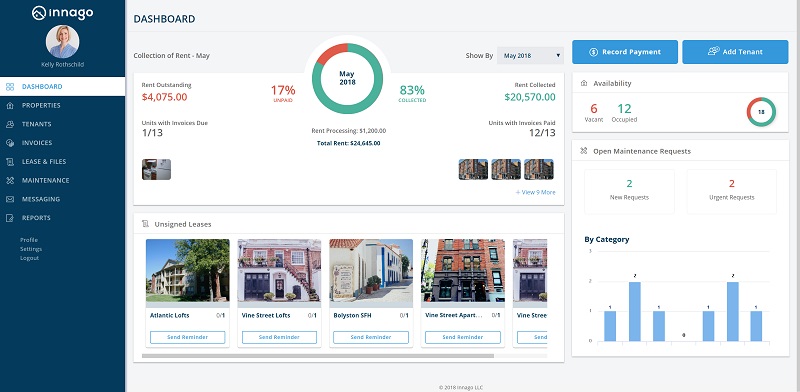

Property Management Firms

Property management firms handling large portfolios benefit the most. Automated rent collection eliminates human error, ensures quick deposits, and keeps owners updated with detailed financial reporting.

For a firm managing 500+ units, automation reduces the workload of multiple staff members and improves accuracy across properties.

Tenants Seeking Convenience

Tenants increasingly prefer digital transactions. Automated systems cater to this demand, providing mobile-friendly solutions that align with modern financial habits.

For young professionals or students, the ability to automate rent ensures peace of mind and reduces the risk of costly late fees.

Why Automated Rent Collection is the Future of Property Management

As digital technology continues to reshape industries, property management is no exception. Automated rent collection addresses the most common challenges in rental operations: late payments, lost checks, manual bookkeeping, and tenant dissatisfaction.

It creates a win-win scenario where landlords secure consistent income, tenants enjoy convenience, and property managers gain efficiency. Over time, automated systems will become the standard for rental transactions, replacing outdated manual processes entirely.

Frequently Asked Questions

1. Is automated rent collection safe?

Yes, automated rent collection platforms use encryption, secure gateways, and compliance standards to protect sensitive information. They are safer than mailing checks or handling cash.

2. Do tenants have to pay extra fees for automated rent collection?

Some platforms allow free ACH transfers, while others may charge fees for credit card payments. It depends on the software, but ACH payments are typically the most cost-effective option.

3. Can automated rent collection handle multiple properties?

Yes, most property management platforms are designed to handle multiple units and properties. This makes them especially useful for landlords or firms with large rental portfolios.