Accept Rent Payments: Complete Guide for Landlords and Property Managers

For landlords and property managers, rent collection is the backbone of maintaining consistent cash flow. Traditionally, rent was collected through checks or cash, but in today’s digital world, the ways to accept rent payments have expanded significantly. From online portals to mobile apps and direct bank transfers, technology has transformed how landlords receive payments and tenants pay their dues.

This article explores the concept of accepting rent payments in detail, highlighting the best methods, real-world products, benefits of technology, and practical use cases.

What Does It Mean to Accept Rent Payments?

To accept rent payments simply means providing tenants with a way to deliver their monthly rent to a landlord or property manager. This can be done manually through checks, cash, or money orders, or electronically using digital tools and platforms.

Modern systems make it possible to accept rent payments via online portals, mobile apps, or direct bank transfers. These solutions are not just convenient; they ensure secure transactions, accurate records, and fewer late payments. Both landlords and tenants benefit from streamlined processes that save time and reduce disputes.

Why Accepting Rent Payments Efficiently Matters

For landlords, timely rent collection is critical to covering expenses like mortgages, maintenance, and utilities. If the process is inefficient or unreliable, it can lead to late fees, strained tenant relationships, or even cash flow shortages.

Tenants, on the other hand, expect convenient and flexible ways to pay. Just like paying utility bills or shopping online, they prefer digital methods. By offering modern ways to accept rent payments, landlords show professionalism, improve tenant satisfaction, and reduce administrative burdens.

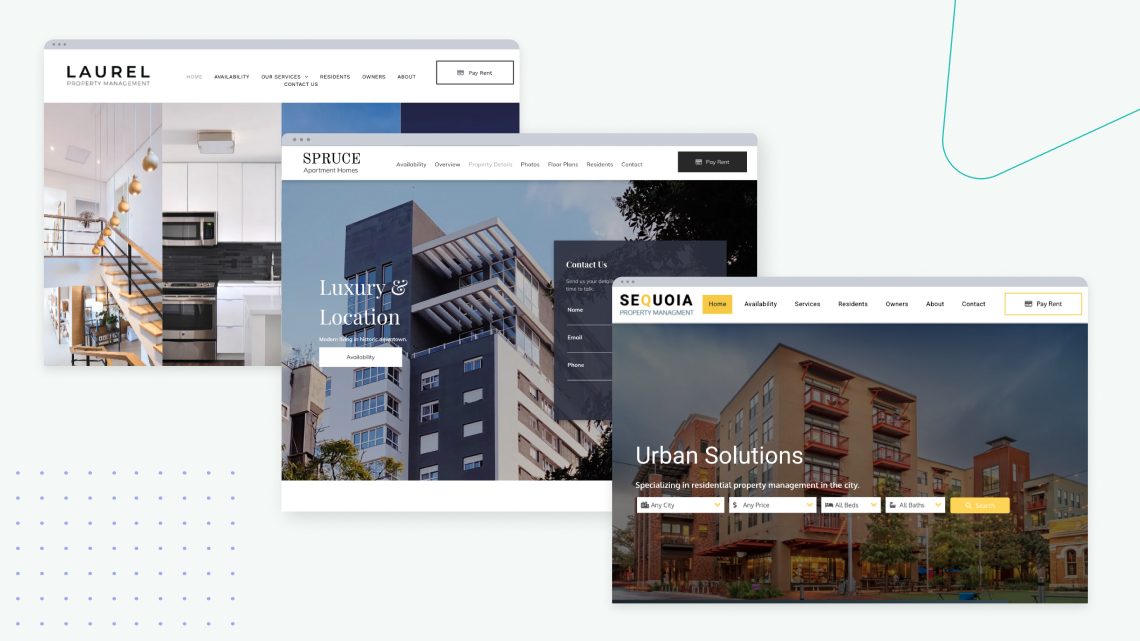

Real-World Examples of Solutions to Accept Rent Payments

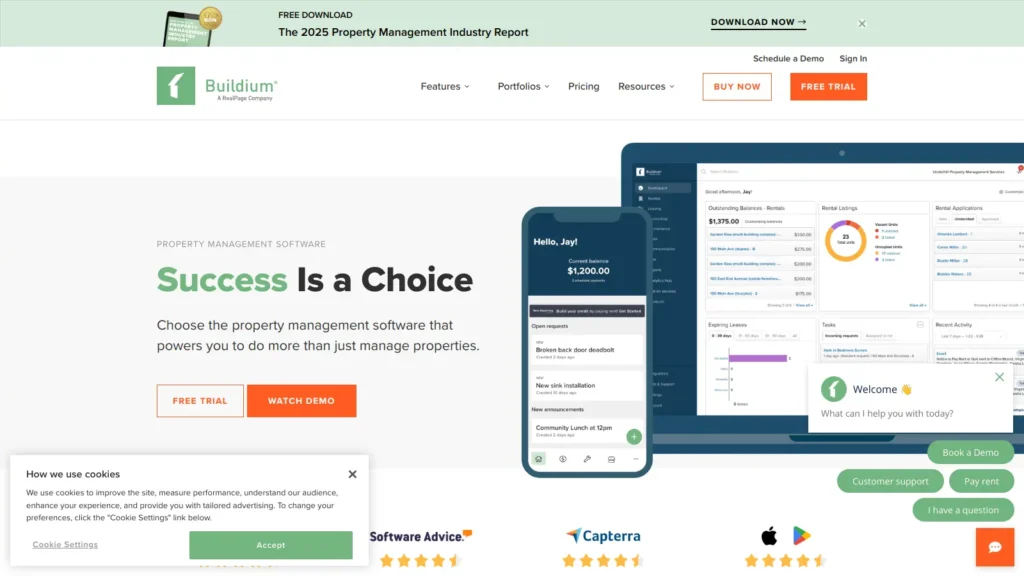

Buildium

Buildium is a property management software designed for landlords who want a complete solution for handling tenants and finances. One of its strongest features is the ability to accept rent payments online through ACH transfers or credit cards.

This platform gives tenants a secure online portal where they can make payments instantly. For landlords, Buildium automates late fees, provides detailed reporting, and integrates with accounting tools. This ensures transparency and reduces the need for manual tracking, making rent collection nearly effortless.

AppFolio

AppFolio is a comprehensive property management system. That allows landlords to accept rent payments directly through their platform. Tenants can pay using recurring online transfers, credit cards, or even via cash payments at supported retail locations.

What makes AppFolio stand out is its flexibility and automation. The system not only processes payments but also updates tenant ledgers, sends reminders, and creates financial reports. This gives landlords complete visibility into payment history while reducing the administrative load.

PayPal

While not exclusively designed for property management, PayPal is widely used by landlords to accept rent payments. Its global recognition and secure infrastructure make it a trusted option for tenants.

Landlords receive instant notifications of payments, and tenants can use either their PayPal balance, bank account, or credit card. The transaction history provides reliable documentation for both parties. Although transaction fees may apply, PayPal remains a practical choice for landlords with a small number of units or tenants who prefer widely accessible platforms.

Zelle

Zelle is increasingly popular for rent payments due to its direct bank-to-bank transfer feature. It allows tenants to send payments instantly to landlords without additional fees in most cases.

The major advantage of Zelle is its convenience. Since it is integrated with many major banks, tenants do not need to download or use a separate platform. However, it does not offer advanced features like automatic reminders or payment reporting, making it best for smaller rental operations.

Benefits of Accepting Rent Payments with Technology

Convenience and Flexibility

Digital rent payment platforms allow tenants to pay from anywhere, anytime, using their preferred method, whether that’s a mobile phone, credit card, or direct bank transfer. Landlords no longer need to chase down checks or schedule in-person meetings.

Improved Cash Flow Management

With recurring and automated payments, landlords enjoy more predictable cash flow. Rent arrives on time, reducing financial strain and ensuring that expenses such as mortgages or maintenance costs are covered without disruption.

Enhanced Security

Unlike cash or paper checks, digital transactions are encrypted and traceable. This reduces the risks of theft, fraud, or misplaced funds. Secure systems also create trust between tenants and landlords.

Accurate Record-Keeping

Modern rent collection platforms automatically generate payment histories and financial reports. This eliminates errors and reduces disputes, while also simplifying tax preparation and compliance.

Professionalism and Tenant Satisfaction

Offering multiple modern payment options positions landlords as professional and tenant-friendly. Tenants value convenience, and when their needs are met, they are more likely to renew leases and recommend the property to others.

Practical Use Cases for Accepting Rent Payments

Reducing Late Payments

Tenants often forget due dates, but with digital platforms, landlords can send automatic reminders or allow tenants to schedule recurring payments. This drastically reduces late payments and associated conflicts.

Multi-Property Landlords

For landlords managing multiple rental units, manually tracking payments can be overwhelming. Online rent collection systems centralize all transactions, making it easy to manage finances across multiple properties.

Long-Distance Property Management

Landlords who live far from their rental properties benefit greatly from electronic rent collection. Tenants can pay instantly online, while landlords receive funds without needing to be physically present.

Helping Tenants with Diverse Needs

Some tenants prefer credit cards, while others want direct transfers. Offering multiple payment options accommodates different preferences, leading to higher tenant satisfaction and fewer complaints.

Challenges to Consider

While technology simplifies rent collection, landlords should also be aware of challenges.

- Fees: Some platforms charge transaction fees, which can affect overall profitability.

- Digital Divide: Not all tenants may be comfortable with online payments, especially in older demographics.

- Regulatory Compliance: Depending on location, landlords must ensure their chosen platform complies with housing and rental laws.

By understanding these challenges, landlords can set clear policies and choose the platform that fits their property management strategy.

The Future of Rent Payment Systems

As digital adoption grows, the way landlords accept rent payments will continue to evolve. Future trends may include blockchain-based rental agreements, biometric security for transactions, and AI-powered financial insights.

Younger tenants already expect digital payment solutions, and landlords who adapt early will maintain a competitive advantage. The future points toward fully automated rent collection with enhanced security, predictive analytics, and seamless integration into property management systems.

Frequently Asked Questions

1. Is it safe to accept rent payments online?

Yes, most platforms use bank-level encryption and fraud detection. As long as landlords choose trusted services, accepting rent payments online is safer than handling cash or paper checks.

2. Do tenants need special apps to pay rent electronically?

It depends on the platform. Some require dedicated apps like Buildium or AppFolio, while others, like Zelle, work directly through major banking apps. Landlords should offer options that best fit their tenant base.

3. What if a tenant prefers traditional payment methods?

While many landlords encourage digital payments, it’s common to offer flexibility for tenants who prefer checks or money orders. However, digital solutions are increasingly standard and help streamline the process for everyone.