Collect Rent Electronically: Complete Guide to Modern Rental Payments

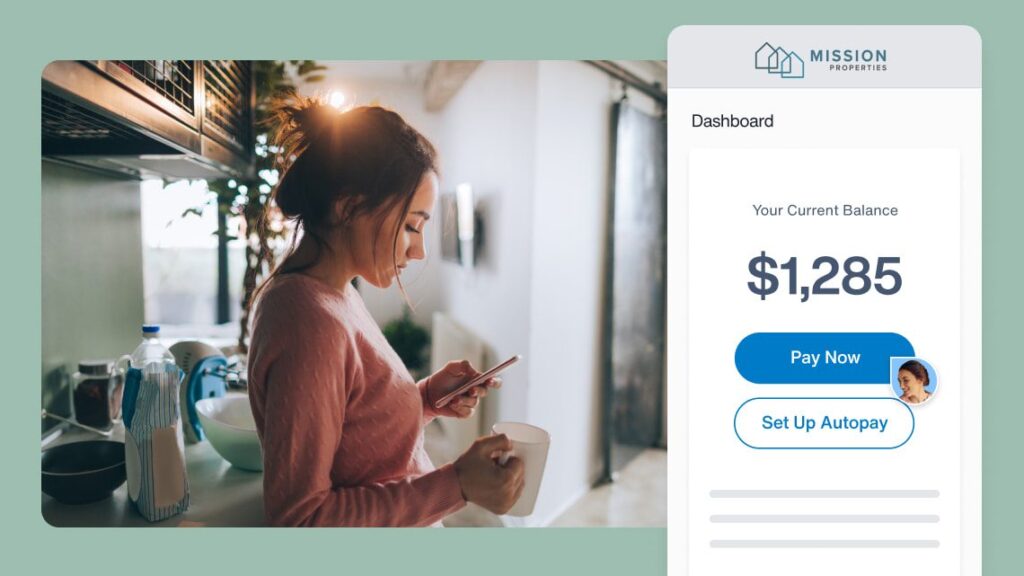

Collecting rent electronically has become a standard in modern property management, replacing outdated cash or check systems. Landlords and tenants alike are embracing digital solutions for their speed, convenience, and transparency. This guide explores the concept of collecting rent electronically in detail, including its benefits, real-world product examples, and practical use cases that show why this system is transforming the rental industry.

What Does It Mean to Collect Rent Electronically?

Collecting rent electronically refers to using digital platforms or payment solutions to receive rent payments from tenants. Instead of writing a check, sending money orders, or paying in cash, tenants can now use secure platforms such as online banking transfers, mobile payment apps, or dedicated rental management software.

Electronic rent collection isn’t just about convenience; it also provides better record-keeping, reduced human error, and enhanced trust between landlords and tenants. These systems often integrate automatic reminders, recurring payment options, and detailed transaction histories that benefit both parties.

Why Collect Rent Electronically Matters Today

The traditional rent collection process is not only time-consuming but also prone to delays and disputes. Electronic collection offers a reliable alternative by ensuring payments are received on time, securely processed, and automatically recorded.

In today’s digital-first environment, landlords who adopt electronic rent collection methods position themselves as modern, professional, and tenant-friendly. Tenants increasingly expect the ability to make payments online just as easily as they pay for utilities, subscriptions, or groceries.

Real-World Products That Enable Electronic Rent Collection

Buildium Property Management Software

Buildium is a property management platform designed to simplify every aspect of managing rental properties. One of its key features is electronic rent collection, where tenants can log into their portal and make payments using ACH transfers or credit cards.

This system benefits landlords with instant updates, automated late fee application, and easy tracking of all payments. For tenants, it provides a hassle-free option to pay anytime, anywhere. Buildium also integrates with accounting tools, allowing landlords to generate financial reports automatically.

AppFolio

AppFolio is a comprehensive property management software solution popular among landlords managing multiple properties. Its electronic rent collection feature allows tenants to set up recurring payments, reducing the risk of late payments.

With AppFolio, property managers gain access to digital ledgers, payment histories, and customizable reporting features. Tenants appreciate the mobile app that makes it easy to submit payments on the go. By streamlining payment processes, AppFolio improves cash flow consistency and reduces manual workload.

PayPal for Rent Payments

Although PayPal isn’t built specifically for rental management, many landlords use it to collect rent electronically. It’s widely trusted, easy to set up, and offers both tenant and landlord protection.

PayPal provides instant payment notifications, a secure system for transactions, and the ability to track rental income separately. While fees may apply for certain types of transactions, PayPal remains a practical option for small landlords or those with only a few tenants.

Zelle for Direct Bank Transfers

Zelle has become a popular method for tenants to send rent directly to landlords through bank-to-bank transfers. With no fees for most users and real-time transfers, Zelle provides a convenient and cost-effective way to collect rent electronically.

It works seamlessly within many major banking apps, meaning tenants don’t need to download separate software. However, it lacks advanced features like automatic reminders or reporting, so it’s best suited for smaller rental arrangements where simplicity is key.

Benefits of Collecting Rent Electronically

Adopting electronic rent collection offers multiple benefits that improve efficiency and strengthen landlord-tenant relationships.

Convenience and Time-Saving

Electronic payments remove the need for physical checks, bank visits, or face-to-face meetings. Landlords save time by automating payment tracking, while tenants enjoy the flexibility of paying from their phones or computers.

Improved Cash Flow

Automated and recurring payment options help ensure that landlords receive rent on time, every time. Predictable cash flow allows property owners to manage expenses such as maintenance and mortgages without delays.

Enhanced Security

Unlike cash or checks, electronic payments are encrypted and tracked within secure systems. This reduces the risks of theft, fraud, or misplaced funds. Tenants feel more confident knowing their payments are safely processed.

Better Record-Keeping

Digital payment systems automatically record transactions, reducing errors and eliminating disputes. Landlords can easily generate financial summaries, while tenants can access their payment history for reference.

Professional Image

Offering electronic rent collection demonstrates that a landlord or property manager is modern and professional. This can enhance tenant satisfaction and attract prospective renters who value convenience.

Practical Use Cases of Electronic Rent Collection

Reducing Late Payments

Tenants often forget payment dates, especially when juggling multiple bills. Electronic systems solve this by offering recurring payments or automated reminders. This reduces late fees and conflicts between tenants and landlords.

Managing Multiple Properties Efficiently

For landlords with several units, manual rent collection becomes overwhelming. With digital platforms, all payments can be tracked in one place, allowing managers to handle multiple properties without stress.

Remote or Out-of-State Landlords

Electronic rent collection is particularly useful for landlords who don’t live near their rental properties. Instead of mailing checks or scheduling in-person meetings, tenants can pay instantly from anywhere, ensuring smooth management from a distance.

Tenant Satisfaction and Retention

Offering digital payment options makes renting easier for tenants. When tenants feel their needs are met with convenience, they are more likely to renew leases and recommend the property to others.

Challenges to Be Aware Of

While electronic rent collection offers significant advantages, landlords should also be aware of potential challenges.

- Transaction Fees: Some platforms charge fees for credit card payments or transfers, which may affect profit margins.

- Technical Barriers: Not all tenants are tech-savvy or have easy access to online payment systems.

- Fraud Risks: Though rare, digital transactions can still be targeted by scams if not properly secured.

Understanding these challenges allows landlords to choose the right platform and educate tenants effectively.

The Future of Rent Collection

The trend toward digital payments will only continue to grow. With innovations like blockchain-based transactions, AI-powered financial management, and integration with smart home technology, the way landlords and tenants handle rent will become even more seamless.

As younger, tech-oriented tenants enter the rental market, electronic rent collection will become the default rather than the exception. Landlords who adapt early will benefit from smoother operations and stronger tenant relationships.

Frequently Asked Questions

1. Is collecting rent electronically safe?

Yes, most platforms use bank-level encryption and secure authentication methods. As long as landlords choose reputable services, electronic rent collection is safer than cash or checks.

2. Can tenants still pay manually if they prefer?

Many systems allow tenants to opt for manual payments, though landlords may encourage electronic options for convenience. Offering flexibility ensures tenant satisfaction.

3. What if a tenant refuses to pay electronically?

While most tenants appreciate the convenience, landlords should be prepared with alternative payment methods. Open communication is key; some tenants may need education or reassurance about the safety of digital systems.