Landlord Collect Rent Online: Complete Guide, Benefits, and Best Tools for 2025

For decades, collecting rent was a manual and often stressful process for landlords. Checks could get lost in the mail, cash is required for in-person meetings, and tenants often miss due dates due to a lack of reminders. With advancements in financial technology, landlords can now collect rent online, making the process more secure, transparent, and efficient.

The shift toward online rent collection is not just about convenience. It represents a fundamental change in property management. Tenants today expect digital solutions, and landlords who adapt can significantly improve cash flow, reduce administrative workload, and provide a modern rental experience.

Why Collecting Rent Online is Becoming Essential

Online rent collection has moved from being a “nice-to-have” feature to a standard expectation in 2025. Younger tenants, especially Millennials and Gen Z, are accustomed to managing their finances digitally. This demand puts pressure on landlords to move away from traditional collection methods.

Additionally, online systems help landlords maintain clear records of payments, automate reminders, and enforce late fees without uncomfortable conversations. It also reduces the risk of fraud, as digital transactions leave a secure and traceable trail. The rise of online banking, peer-to-peer transfers, and property management software has further accelerated this trend.

Benefits of Collecting Rent Online

Improved Cash Flow Management

One of the most significant benefits for landlords is faster access to funds. Online payments typically clear quickly than paper checks, reducing the waiting period. This timely access helps landlords cover mortgage payments, property repairs, and operational expenses with more certainty.

Furthermore, automated recurring payments ensure tenants are less likely to forget their due dates. This reduces late rent issues, allowing landlords to plan their monthly finances with confidence.

Enhanced Record Keeping and Transparency

Digital rent collection automatically generates detailed transaction histories. Landlords no longer need to manually track who paid and when. Tenants also benefit by having receipts and access to payment histories, creating a transparent relationship between both parties.

This transparency is especially useful during tax season or when disputes arise. Clear records minimize misunderstandings and ensure accountability.

Reduced Administrative Burden

Traditional rent collection requires manual follow-ups, deposit slips, and constant communication with tenants. Online systems automate much of this work. Automated reminders, instant payment confirmations, and customizable late fee applications save hours each month.

This efficiency allows landlords to focus on improving properties and enhancing tenant satisfaction rather than handling administrative tasks.

Real-World Examples of Online Rent Collection Tools

Buildium

Buildium is a property management software designed to handle multiple aspects of rental property administration. Its online rent collection system allows tenants to pay via credit card, debit card, or ACH transfer. Payments are processed quickly and deposited directly into the landlord’s account.

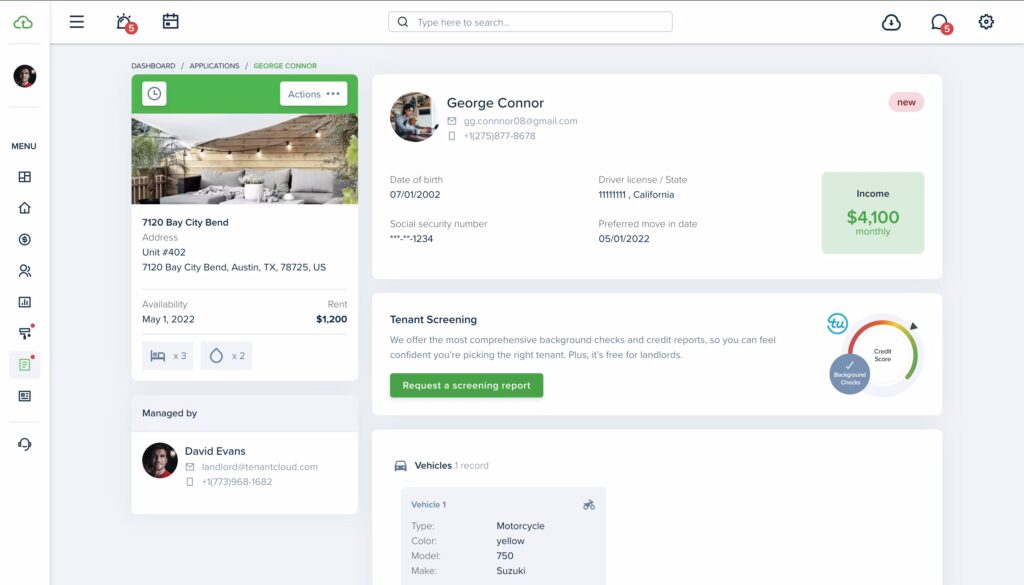

The software also integrates with accounting tools, automatically syncing rent payments with financial records. This is particularly beneficial for landlords managing multiple properties who want a unified dashboard for finances, maintenance requests, and tenant communication.

AppFolio

AppFolio offers landlords an end-to-end property management solution, with rent collection being a standout feature. Tenants can set up automatic payments, while landlords can establish customized late fee policies that the system enforces automatically.

The tool provides powerful reporting and analytics, helping landlords spot patterns in rent collection, identify late-paying tenants, and forecast financial performance. For landlords with large portfolios, these insights are invaluable in maintaining steady cash flow.

Cozy (now part of Apartments.com)

Cozy, now integrated with Apartments.com, was one of the most popular free rent collection tools for landlords. It allows direct transfers from tenant bank accounts to landlord accounts with no fees for standard transactions.

What makes Cozy appealing is its tenant-friendly interface and flexibility. Tenants can choose one-time payments or recurring schedules, and landlords receive notifications instantly. For small landlords or those just starting, this tool offers a cost-effective entry point to digital rent collection.

PayRent

PayRent specializes specifically in digital rent payments. Unlike broader property management software, it focuses solely on making the payment process seamless and secure. It offers same-day deposit options, landlord-controlled late fees, and rent reporting to credit bureaus, which encourages tenants to pay on time.

This specialized approach makes it ideal for landlords who don’t need full management software but want a reliable rent collection tool.

Use Cases of Online Rent Collection

Solving the Problem of Late Payments

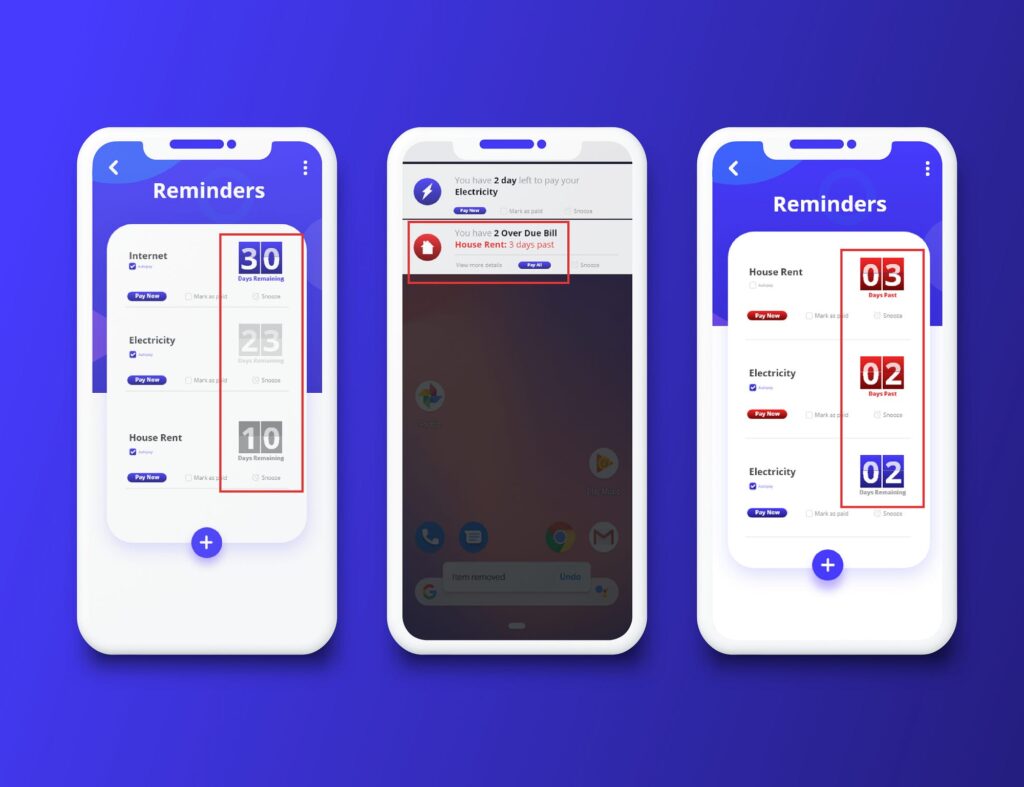

Landlords often struggle with tenants who forget due dates or delay mailing checks. Online platforms solve this by allowing recurring payments. For example, a tenant can schedule rent to be automatically deducted on the first of every month, removing human error from the equation.

This reduces tension between landlords and tenants, as reminders and penalties are system-generated, not personal. Over time, this improves relationships and ensures predictable rental income.

Enhancing Security for Both Parties

Carrying cash or mailing checks exposes both landlords and tenants to potential theft or fraud. Online rent collection minimizes these risks. Payments are encrypted, protected by banking-level security measures, and documented in real-time.

This level of protection reassures tenants while protecting landlords from disputes over lost checks or missing payments.

Streamlining Property Management for Multi-Unit Owners

For landlords managing multiple units, traditional collection can be overwhelming. Online platforms consolidate all rent payments into one dashboard, showing real-time updates. Landlords can instantly see which units are current and which are overdue.

This consolidated view allows for quicker decision-making and more efficient financial planning. It also simplifies communication since automated reminders are sent to multiple tenants simultaneously.

Practical Advantages of Technology in Rent Collection

Digital rent collection represents more than just convenience it’s a practical solution to everyday challenges. The integration of payment automation reduces errors, while accounting synchronization minimizes the workload of financial reconciliation.

Tenants benefit as well, with access to mobile-friendly platforms that fit into their daily lives. Being able to pay rent on the go not only increases satisfaction but also helps retain long-term tenants who value ease and modern service.

Frequently Asked Questions

1. Is online rent collection safe for landlords and tenants?

Yes, most platforms use bank-grade encryption and secure payment gateways. Transactions are traceable, reducing fraud risks. Tenants and landlords also receive digital records, which add transparency and accountability.

2. Do tenants prefer paying rent online?

Many tenants today expect digital options for financial transactions. Online payments provide convenience, flexible payment methods, and instant confirmations, making them a preferred choice for most renters.

3. Can small landlords benefit from online rent collection?

Absolutely. Even landlords managing one or two units can save time and reduce stress with online rent collection. Platforms like Cozy or PayRent offer cost-effective solutions tailored for small-scale landlords.